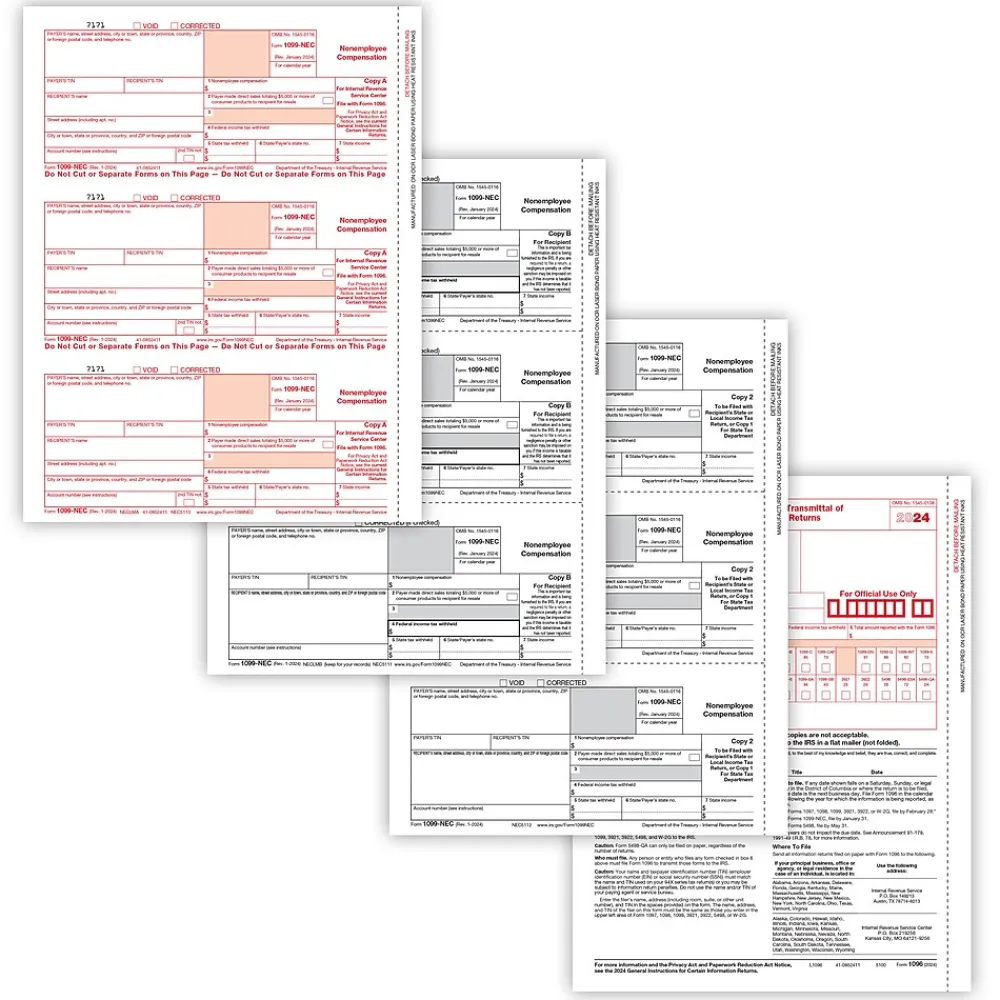

Tax Forms*ComplyRight 2024 1099-NEC Tax Form, 3-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 100/Pack (NEC6102100)

$48.00 Original price was: $48.00.$35.99Current price is: $35.99.

The ComplyRight 1099-NEC (nonemployee compensation) form is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee. Such nonemployees are commonly independent contractors, and the payments may also include payments made to other service providers, such as attorneys. Generally, forms 1099-NEC are required to be filed if at least $600 in payments were made to independent contractors for services performed, or were cash payments for fish purchased from a seller engaged in the trade or business of selling fish. However, there are other payments for which forms 1099-NEC are required.

- 1099-NEC tax form set is created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

- Includes three-part tax forms

- 3-up page format: three forms on a single sheet

- Includes: Copy A (100), Copy B (100), Copy C/2 (100), and 1096 Transmittal (three) forms

- 100 tax form sets per pack

- For laser printers

| Attribute name | Attribute value |

|---|---|

| Acid Free | 11 |

| Number of Parts | 51+ |

| Print Type The different types of selling UOM: Pack, Case, Carton, etc | Pack |

| Tax Form Pack Size | 1099-NEC |

| True Color The overall width of the product, measured left to right. | 8.5 |

| Year The tax year the form is applicable to. | 2024 |

Be the first to review “Tax Forms*ComplyRight 2024 1099-NEC Tax Form, 3-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 100/Pack (NEC6102100)” Cancel reply

Related products

Copy & Printer Paper

Copy & Printer Paper

Index Cards

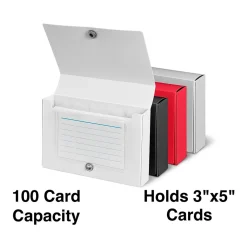

Index Cards*Staples ® Index Card Holder for 3″ x 5″ Cards, 100 Card Capacity, Assorted (ST50992-CC)

Copy & Printer Paper

Easel Paper Pads

Easel Paper Pads*Post-it Super Sticky Tabletop Easel Pad, 20″ x 23″, 20 Sheets/Pad (563DE)

Copy & Printer Paper

Copy & Printer Paper

Copy & Printer Paper

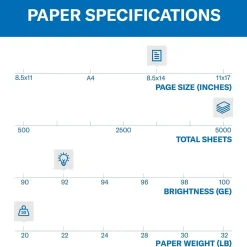

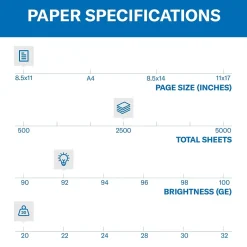

Copy Paper*EarthChoice 8.5″ x 14″ Copy Paper, 20 lbs., 92 Brightness, 500 Sheets/Ream (2702)

Classroom Paper

Copy & Printer Paper

Copy & Printer Paper

Classroom Paper

Classroom Paper*Barker Creek Kai Ola Sea Turtles Computer Paper Pack, 100 Sheets/Set (4204)

Paper

Post-It Notes*Post-it Notes, 3″ x 3″, Canary Collection, 100 Sheet/Pad, 12 Pads/Pack (654-12YW)

Reviews

There are no reviews yet.