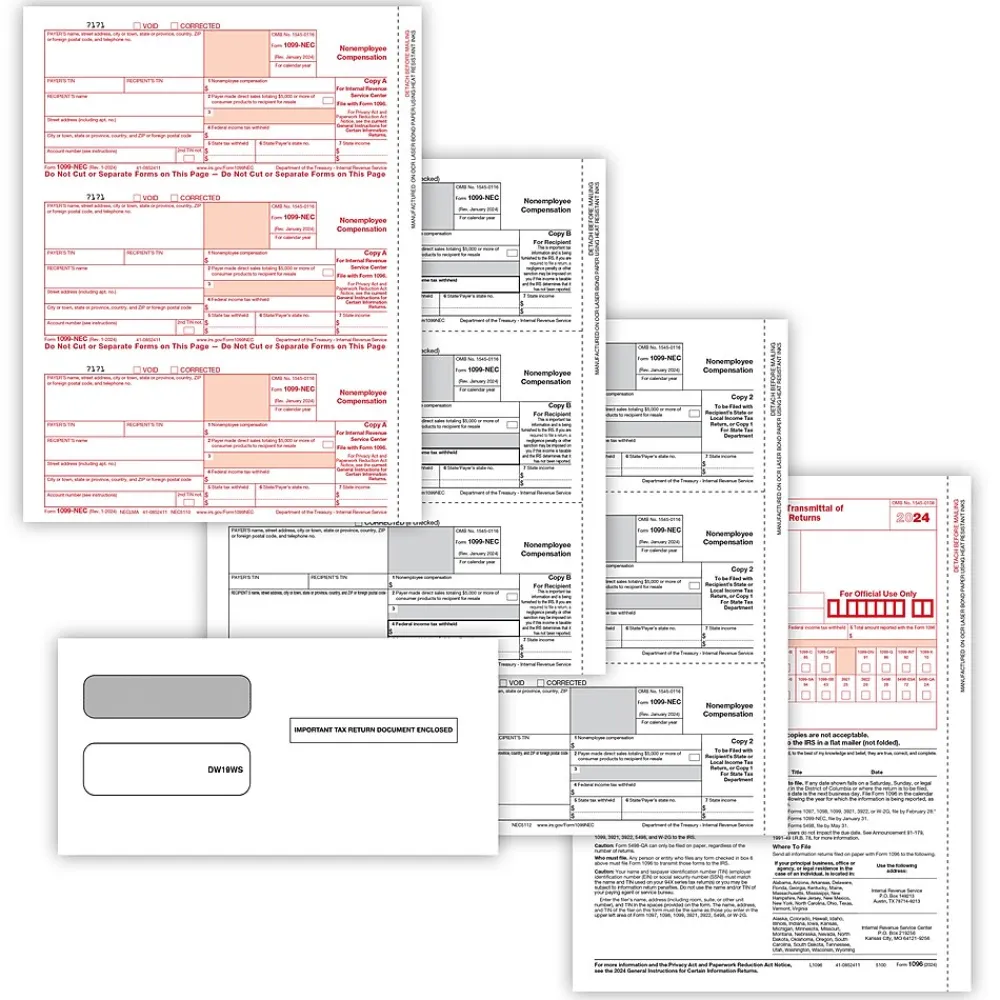

Tax Forms*ComplyRight 2024 1099-NEC Tax Form 50 self-seal envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 50/Pack (NEC6103E)

$25.89

The ComplyRight 1099-NEC (nonemployee compensation) form is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee.

- 1099-NEC (nonemployee compensation) is an IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee

- Includes four-part tax forms

- 3-Up forms: three forms on a single sheet

- Includes Copy A, Copy B, Copy C/2, and 1096 Transmittal forms

- Pack contains 50 tax form sets (50 Copy A, 50 Copy B, 100 Copy C/2, and three 1096 Transmittal forms total) and 50 self-seal envelopes

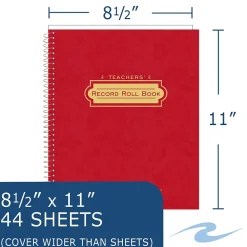

- Dimensions: 8.5″ x 11″

- For laser printers

| Attribute name | Attribute value |

|---|---|

| Acid Free Refers to the items included in a kit. | 50 self-seal envelopes |

| Length in Inches | 4 |

| Number of Recipient or Employees | Laser |

| Selling Quantity (UOM) | 50 |

| Tax Form Type Actual manufacturer name for the color of the product. | Multicolor |

| Width in Inches The tax year the form is applicable to. | 2024 |

Be the first to review “Tax Forms*ComplyRight 2024 1099-NEC Tax Form 50 self-seal envelopes, 4-Part, 3-Up, Copy A, B, C/2, 1096 Transmittal, 50/Pack (NEC6103E)” Cancel reply

Related products

Sale!

Construction Paper

Sale!

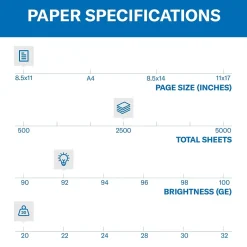

Copy & Printer Paper

Sale!

Copy & Printer Paper

Sale!

Copy & Printer Paper

Sale!

Copy & Printer Paper

Construction Paper

Construction Paper*Crayola Construction Paper Sheets, Assorted Colors, 48/Pack (99-0036)

$4.99

Sale!

Copy & Printer Paper

Construction Paper

Construction Paper*Tru-Ray 9″ x 12″ Construction Paper, Salmon, 50 Sheets (P103010)

$3.89

Sale!

Classroom Paper

Easel Paper Pads

Easel Paper Pads*Post-it Super Sticky Tabletop Easel Pad, 20″ x 23″, 20 Sheets/Pad (563DE)

$24.89

Reviews

There are no reviews yet.